Home Loan EMI Calculator

Principal vs Interest Growth

Amortization Schedule

| Month | EMI | Principal | Interest | Balance |

|---|

Home Loan EMI Calculator: Smart Way to Plan Your Dream Home Finance

Buying your dream home isn't just a financial decision; it's an emotional milestone. But often, in the excitement, people overlook the bank's lengthy calculations and hidden interest costs. Have you ever wondered how much a mere 0.5% rise in the interest rate can affect your bank balance? Or how an extra ₹5 lakh down payment can shorten your loan tenure by several years? We created this tool so that your financial decisions are based not on guesswork, but on solid data.

Who is this guide for?

We know that everyone's financial situation is different. That's why this guide is specifically designed for people in India using the Online Mortgage Calculator India:

- First-Time Home Buyers: Those stepping into the property market for the first time and feeling a bit confused.

- Existing Loan Holders: Who are considering refinancing or balance transferring their loans.

- Real Estate Investors: Who want to calculate the gap between rental yield and EMI.

- Financial Planners: Who want to give their clients a transparent view.

Related Tools You’ll Love

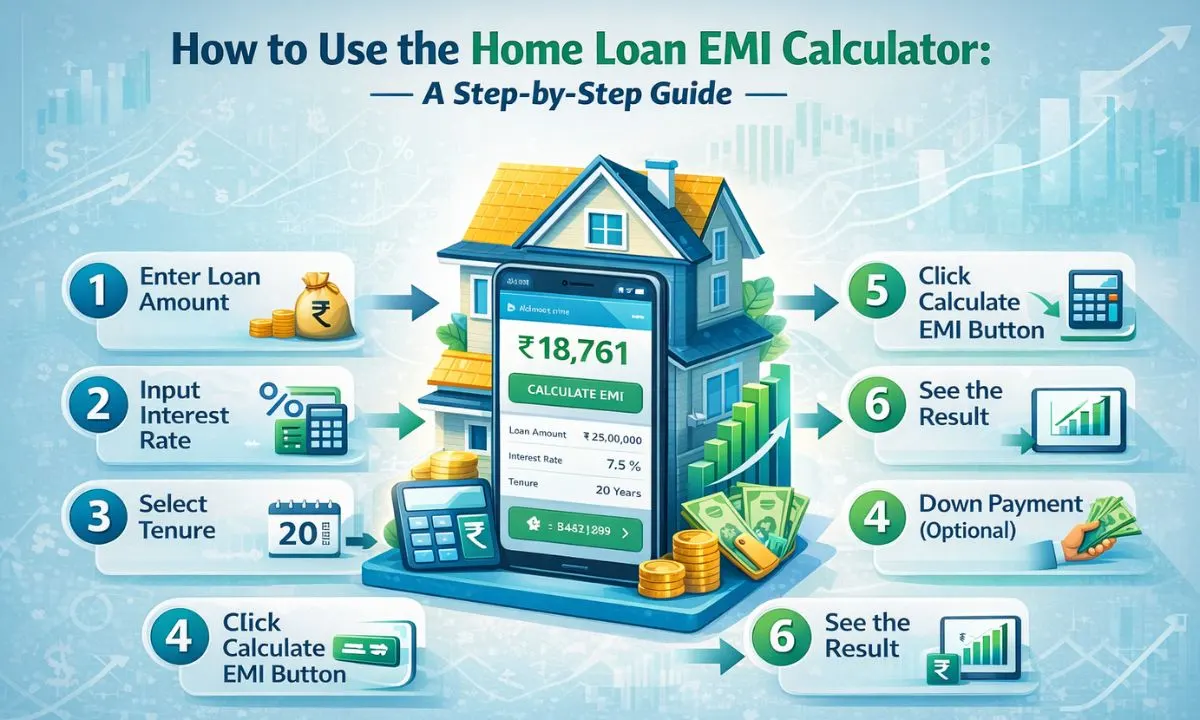

How to Use a Home Loan EMI Calculator: Step-by-Step Guide

Using this Home Loan EMI Calculator is very simple. If you're planning to buy your dream home, this step-by-step guide will greatly help you understand the right EMI and budget.

Step 1: Enter Loan Amount

First, in the “Loan Amount (₹)” box, enter the amount you want to borrow from the bank.

Tip: If you are looking at a 50 lakh house, then enter that same amount here.

Step 2: Fill in the Interest Rate

Now, enter the percentage that the bank is offering you in the “Interest Rate (%)” field. (Tip: Check according to the latest Housing Loan Interest Rate 2026)

Example: If the bank is quoting 8.5%, then enter 8.5 here. Remember, even a small difference has a big impact on your total interest.

Step 3: Choose the Loan Tenure (Years)

In “Loan Tenure (Years),” specify how many years you want to take to repay the loan.

People usually choose 15 to 20 years. The longer the tenure, the lower the EMI will be, but the total interest will increase.

Step 4: Down Payment (Optional)

If you have already saved some money for the house, enter it in the “Down Payment (₹)” box.

The calculator will automatically subtract this amount from the total loan and calculate the EMI on the remaining amount.

Step 5: Click the Calculate EMI Button

After filling in all the details, click the red “Calculate EMI” button below.

How to Understand the Results?

As soon as you click, an EMI Summary will open for you:

1. Monthly EMI: This is the fixed amount you will have to pay the bank every month.

2. Interest Payable: This is the extra money you will pay to the bank as interest.

3. Total Amount: This shows the total amount you will pay, combining your Principal (original amount) and Interest.

Take Advantage of Extra Features:

1. View Schedule: By clicking on this, you can see how much of your payment each month is going toward the principal and how much toward interest. In the early years, the bank charges you more in interest.

2. View Chart: This is a graphical representation that shows you how your loan balance is decreasing over time.

Pro Tips for Smart Planning

| Tip Type | Description |

| The 30/40 Rule | Your total EMI should not exceed 40% of your monthly take-home salary so that it doesn't affect your lifestyle. |

| Tenure Balance | Keeping the tenure short increases the EMI, but reduces the total interest payable by lakhs. |

| Step-Up EMI | If your salary is going to increase every year, be sure to plan prepayments during your tenure. |

Expert Note: Our Home Loan EMI Calculator doesn't just show the EMI; by clicking the “View Chart” button below, you can see how much of your money in the early years is going solely toward interest.

Logic, Formula & Common Mistakes

Many people think that calculating EMI is the bank's job, but understanding how to calculate home loan EMI is also important for you, so that you can easily spot the bank's hidden calculations.

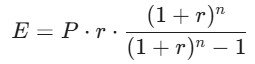

The Mathematical Formula

Our calculator works on the “Reducing Balance Method.” Its standard formula is given below:

Where:

- E: Monthly EMI

- P: Principal Loan Amount (Total Amount - Down Payment)

- r: Monthly interest rate (calculated by dividing the annual rate by 12 and then by 100)

- n: Total Number of Months (Tenure in years × 12)

Common Mistakes to Avoid (Errors that can be costly)

- Ignoring the Impact of Tenure: To keep the EMI low, people often opt for a 30-year tenure. But remember, the longer the tenure, the more interest you will pay the bank. Often, this amount is even higher than the loan amount itself.

- Not Factoring in Processing Fees: The EMI isn't the only cost. Banks charge a processing fee of 0.5% to 1%. Be sure to include this in your budget as well.

- Waiting for Rate Trends: Not keeping an eye on the housing loan interest rate 2026. Sometimes, a 0.25% difference can save you ₹2-3 lakh.

- Desire for Zero Down Payment: People think it's better to get 100% funding, but the less the principal, the more financial freedom you'll have.

Real-World Case Studies (Examples)

Let's see how two different decisions affect your money.

Case Study 1: The Power of Down Payment

Scenario: Mr. Akash wants to buy a ₹60 lakh flat. The bank is offering an 8.5% interest rate for 20 years.

| Feature | Option A (10% Down Payment) | Option B (25% Down Payment) |

| Loan Amount | ₹54,00,000 | ₹45,00,000 |

| Monthly EMI | ₹46,863 | ₹39,053 |

| Total Interest Payable | ₹58,47,215 | ₹48,72,679 |

| Savings | - | ₹9,74,536 |

Insight: By paying just ₹9 lakh extra upfront, Akash saved nearly ₹10 lakh in interest. Our Home Loan EMI Calculator helps you make exactly this comparison.

Case Study 2: Short Tenure vs Long Tenure

If you take a ₹30 lakh loan, the interest difference between 15 years and 25 years is astonishing. In 15 years, you pay less interest, whereas in 25 years, you end up buying the same house for 1.5 times more.

Comparison Guide (Us vs Others)

There are many calculators on the market, but what makes our tool different? Let's find out.

| Feature | Regular Calculators | Our Smart Tool |

| Down Payment Field | It often goes missing. | Dedicated Input for Accuracy |

| Visual Graphics | Only text results | Principal vs Interest Growth Chart |

| Amortization | Only summary | Month-by-month detailed table |

| Speed | Slow loading | Instant client-side processing |

Troubleshooting: Why Aren't the Agar Results Matching?

If your bank is quoting a different EMI, there could be two main reasons:

- Compounding Frequency: Banks sometimes use a daily reducing balance instead of a monthly one.

- Insurance/Pre-EMI: Banks often add the “Home Insurance” premium to the loan amount, which increases the principal.

Pros & Cons + Data Privacy

Taking out a home loan is a disciplined financial journey. But as you know, every coin has two sides.

Pros of Using an Online Tool

- Instant Clarity: Without running around to the bank, you can find out your budget in seconds.

- Scenario Planning: You can easily find your “Sweet Spot” by changing the interest rate and tenure.

- Empowerment: When you meet with the bank manager, you have solid numbers to negotiate with them.

Cons & Limitations

- Estimation Only: This tool only provides a mathematical calculation. The final EMI may include bank taxes and cess.

- Credit Score Factor: The Home Loan Eligibility Calculator will tell you the amount, but the actual interest rate will depend on your credit score (CIBIL).

Data Privacy & Security

Your financial privacy is our priority.

Our tool runs on client-side JavaScript. This means that any data you enter (loan amount, salary, etc.) is not saved on our server. Instead, everything remains within your browser.

Taking out a home loan is not just a financial agreement; it is a secure process governed by banking regulations. In India, to improve housing finance and protect borrowers' interests, the Reserve Bank of India (RBI) has established strict guidelines. Before taking a loan, every borrower should be aware of their fundamental rights (Customer Rights), such as transparency in interest rates and fair recovery practices. For better understanding, you can refer to the RBI's official website for its Master Direction on Housing Finance, which governs borrower protection and bank accountability.

Conclusion: Final Checklist

Home loan planning isn't just a numbers game; it's about securing your future. By using our Home Loan EMI Calculator, you've taken the first step in the right direction. So, always remember:

- Track the latest housing loan interest rate trends for 2026.

- Maintain a balance between the tenure and the EMI.

- Always keep the prepayment option open.

Frequently Asked Questions (FAQs)

People often have these questions when they search for an online mortgage calculator India:

Can I change the loan's tenure in the middle?

Yes, absolutely—it's called “restructuring.” If your income increases, you can shorten the tenure to save on interest.

What tax rebate is available under Section 24b?

For self-occupied property, you can claim a tax benefit on interest payments up to ₹200,000.

Which is better, a fixed or a floating interest rate?

In the 2026 housing loan interest rate scenario, floating rates are often better because you benefit when the market goes down, but people choose fixed rates for stability.

What is prepayment and what are its benefits?

If you have extra money and use it to pay off your loan, that's called prepayment. It directly reduces the principal in your principal vs. interest breakdown.

Does the calculator include processing fees?

No, our tool only calculates the EMI. Processing fees vary from bank to bank (usually 0.5%–1%).

What should the down payment be?

Ideally, you should make a 20% down payment, because this keeps the loan-to-value (LTV) ratio in check and reduces the interest.

Why should you check the Amortization Schedule?

It shows you how much of your monthly EMI is going towards the principal and how much towards the interest. The interest is higher in the initial years.

Does a CIBIL score affect EMI?

Not directly on EMI, but it does affect the interest rate. A good CIBIL score means a lower interest rate, which indirectly reduces your EMI.