Loan Foreclosure Calculator

Loan Details

Loan Foreclosure Calculator: Can You Save Lakhs of Rupees by Paying Off Your Loan Early?

Did you know that when you take out a loan from a bank, for the first few years, a large portion of the EMI you pay goes towards paying off just the interest?

Just think, you're paying a large portion of your hard-earned salary to the bank every month, but your ‘Principal Amount’ (the actual loan amount) is decreasing very slowly. This situation is known as “Front-loaded interest” in financial terms.

We all dream of living a debt-free life. But often we're caught in the confusion of, “Is it wise to pay a 2–3% penalty to the bank to close a loan?” Or, “Is the interest I've saved so substantial that I should consider foreclosure?”

These are the very questions we designed this Loan Foreclosure Calculator to answer. This tool doesn't just show numbers; it tells you how to make a smart decision so that your hard-earned money stays in your savings instead of ending up in the bank's pocket.

Why Is It Important to Understand Loan Prepayment and Foreclosure?

The path to financial freedom isn't paved by hard work, but by sound calculations. When you use our Home Loan Foreclosure Penalty Calculator, you'll find out:

- What your actual personal loan foreclosure savings figure is.

- Whether you're in profit or loss even after paying the foreclosure penalty.

- How much interest you can save on paying over the next few years.

Who is this calculator for?

Every borrower is at a different stage. Our Loan Foreclosure Calculator is specifically designed for those who:

- Smart Home Loan Borrowers: Home loans are for long terms, such as 15 to 30 years. If you've saved a large amount and want to calculate loan prepayment benefits, this tool can save you hundreds of thousands of rupees.

- Personal Loan Holders: Personal loans often carry interest rates between 10% and 25%, which is quite high. Here, calculating Personal Loan Foreclosure Savings becomes most important because the opportunity for savings is greatest.

- Salaried Professionals (Bonus/Appraisal): Those who receive a bonus at the end of the year and want to reduce their debt burden. It's important for them to know whether it's better to invest the money or pay off the loan.

- Debt-Free Enthusiasts: Those who want peace of mind and are looking for Debt Free Fast Tips. For them, this calculator serves as a roadmap.

Expert Insight: If you're between 25% and 50% of your loan tenure, then foreclosing could prove to be a “gold mine” for you. As the tenure draws to a close, the interest savings decrease.

Step-by-Step Instructions for Using the Tool

Our Home Loan Foreclosure Penalty Calculator is user-friendly, but to accurately interpret the results, you should follow these steps. This tool shows you an exact graph of your Personal Loan Foreclosure Savings.

Step 1: Loan Amount (₹)

Enter your total borrowed amount here. Example: If you took a loan of ₹500,000, enter 5,00,000.

Step 2: Interest Rate (% p.a.)

What is the annual interest rate your bank is charging you? (Standard rates range from 10.5% to 15%).

1. Tenure (Months): Enter your total loan period in months. (e.g., 3 years = 36 months).

2. EMIs Paid So Far: This is the most important step. How many Equated Monthly Installments (EMIs) have you paid so far?

3. Foreclosure Penalty (%): Banks charge a penalty of 2% to 4% for closing the loan early. Check your loan agreement and enter it here.

Step 3: Calculate Savings Button

As soon as you click, you will see the result in an Amortization Schedule Explained format.

Pro Tips: How to Maximize Savings?

If you're truly looking for debt free fast tips, be sure to keep these points in mind:

- The 50% Rule: Try to foreclose your loan only when you have less than 50% of the total tenure remaining. Because after that, you are only paying off the principal, not the interest.

- Check for Zero Penalty: Many banks, especially on floating-rate home loans, charge a zero foreclosure penalty. In that case, enter 0% for the penalty in the calculator and see how much profit you stand to make.

- Analyze the Pie Chart: The chart in the results box instantly shows you how much your Net Savings (green) exceeds your Penalty Cost (red). If the green slice is larger, close the loan immediately!

- Use the Statement: Click on “Show Loan Statement” to see how quickly your ‘Closing Balance’ is decreasing each month.

Comparison Table: Foreclosure vs Regular EMI

| Feature | Regular EMI Payment | Smart Foreclosure |

| Total Interest | You will have to pay the full interest. | Only the interest to date will be charged. |

| Mental Peace | Monthly stress | Freedom at once |

| Net Savings | 0% | Up to 15-20% of Loan Amount |

| Cash Flow | Blocked | Future income becomes free. |

Logic/Formula Explanation + Common Mistakes to Avoid

Often people think that loan foreclosure means only paying the remaining principal. But behind it lies a complex mathematical logic that our Loan Foreclosure Calculator solves in seconds.

Calculation Logic (The Math)

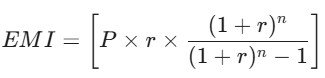

The loan calculation is based on the Reducing Balance Method. Its formula is something like this:

Here:

- P: Loan Amount

- r: Monthly Interest Rate (Annual Rate / 12 / 100)

- n: Tenure in months

What happens at the time of foreclosure? Our tool first uses the Amortization Schedule Explained logic to calculate how much of each EMI you have paid went towards the principal and how much towards the interest. At the time of foreclosure, you only have to pay the “Outstanding Principal,” not the interest for the upcoming months.

Simple Logic: > Net Savings = (Total Future Interest) - (Foreclosure Penalty)

Common Mistakes People Make (Avoid These!)

- Ignoring the Penalty Rate: Many times people think a 2% penalty is very small. But this 2% is applied to your ‘Outstanding Principal,’ which can be a large amount. Our Home Loan Foreclosure Penalty Calculator shows you the “Net Savings” by deducting this beforehand.

- Not Considering Tax Benefits: If you have a home loan, you get a tax deduction on the interest under Section 24(b). Before foreclosing, check if the interest savings are greater than your tax benefit.

- Foreclosing at the End of the Tenure: This is the biggest mistake. In the last 1-2 years of the loan, you have already paid the maximum interest. Foreclosing at this time can make the foreclosure charges negatively impact your ROI.

- Incorrect Outstanding Input: People often mistake the total loan amount for the outstanding balance. Our Loan Foreclosure Calculator automatically calculates the current balance based on the EMIs already paid.

Checklist: When Shouldn't You Foreclose?

- If you are getting a return on investment (ROI) that is higher than the loan's interest rate (e.g., in Equity/Mutual Funds).

- If 80% of the loan's term has already passed.

- If you need emergency funds (liquidity crunch).

Real-world Case Studies / Examples

When our Loan Foreclosure Calculator processes the data, the results are as follows:

Case Study 1: The Smart Saver (Personal Loan)

Rahul took a ₹500,000 personal loan at 14% interest for 5 years (60 months). After paying 2 years (24 EMIs), Rahul received ₹300,000 and decided to close the loan.

- Remaining Tenure: 36 Months

- Outstanding Principal: ~₹3,45,000

- Foreclosure Penalty (3%): ₹10,350

- Interest Saved (Future): ~₹80,000

- Net Savings: ₹69,650

Result: Rahul paid a penalty of ₹10,350 but saved ₹80,000 in interest in return. This was a very wise decision.

Case Study 2: The Home Loan Dilemma

Priya's home loan is for ₹40,00,000 at 9% interest for 20 years. She has completed 15 years (180 EMIs). Now she wants to close the loan.

- Outstanding Principal: ~₹18,00,000

- Foreclosure Penalty: 0% (Floating rate home loan)

- Interest Saved: ~₹4,50,000

- Net Savings: ₹4,50,000

Analysis: Priya didn't have to pay any penalty, so her savings increased even more. However, since she was near the end of the tenure, her monthly interest component had already decreased.

Pro Tip for Home Buyers: If you're thinking of buying a new home or want to calculate your current loan's installment (EMI), be sure to check out our Home Loan EMI Calculator. Before deciding on foreclosure, it's important to know how much of your monthly EMI is interest and how much is principal, so you can optimize your savings more effectively.

Comparison: Early vs. Late Foreclosure

From the table below, understand how important timing is:

| Loan Stage | Interest Component | Savings Potential | Decision |

| First 25% Tenure | Very High | ⭐⭐⭐⭐⭐ (Excellent) | Stop immediately! |

| Mid 50% Tenure | Moderate | ⭐⭐⭐ (Good) | Calculate and see. |

| Last 25% Tenure | Very Low | ⭐ (Poor) | Maybe it's better not to do it. |

Pro Tip for Real Estate

Even if you can't opt for foreclosure on your home loan, paying one extra EMI each year can reduce your tenure from 20 years to about 17 years. Our tool is an expert at showing you the precise balance between interest outgo and principal repayment.

Comparison Guide (Us vs Others) + Troubleshooting Section

There are many Loan Foreclosure Calculators on the Internet, but do they show you the full picture? Our Loan Foreclosure Calculator is completely different from the others because it doesn't just give you numbers, but also visual data.

Why Our Tool is Different?

| Feature | Ordinary Calculators | Our Foreclosure Tool |

| Real-time Chart | Not working (Only text results) | Interactive Pie Chart (Savings vs Penalty) |

| Amortization Table | It only shows the final amount. | Full Monthly Breakdown (Paid vs Unpaid) |

| User Experience | Complex inputs and ads | Clean, Fast, and Optimized |

| Accuracy | Approximate figures | Precise Mathematical Logic |

| Privacy | It can be saved on the data server | 100% Client-side (Your data is safe) |

Troubleshooting: What to Do If the Tool Doesn't Work?

Sometimes, calculation issues can occur due to incorrect data or browser settings. The solutions for these common problems are provided below:

- “Paid EMIs cannot exceed tenure!” Error: This error occurs when you have entered more EMIs paid than the total tenure (months). Solution: Check that if the tenure is 36 months, then the paid EMIs should be 35 or less.

- Chart Not Loading: Our tool uses Chart.js. If your internet is slow or your browser is outdated, the chart won't display. Solution: Refresh the page or use the Chrome/Edge browser.

- EMI Amount Doesn't Match with the Bank: Banks often add extra insurance charges or hidden fees to the EMI. Solution: Enter only the ‘Base Interest Rate’ in the Loan Foreclosure Calculator. A slight difference (₹50-₹100) is normal.

- Negative Savings: If you foreclose on the very last month of your loan, the penalty can exceed the savings. Solution: In such cases, it's better not to foreclose.

Expert Note: Our tool works like an Early Loan Settlement Guide. If you see ‘Net Savings’ in green in the results, it means you are still making a profit even after paying the penalty to the bank.

Performance Tip:

Bookmark this tool on your mobile. Whenever you talk to your bank manager, you can do an on-the-spot calculation and show them how much you should be saving.

Pros & Cons + Disclaimer + Data Privacy

Foreclosure isn't right for everyone. That's why it's important to understand both sides of this Early Loan Settlement Guide before making a decision.

Pros of Foreclosure

- Massive Interest Savings: As our Loan Foreclosure Calculator shows, you can save hundreds of thousands of rupees in interest.

- Improved Debt-to-Income Ratio: Paying off the loan increases your eligibility for new loans in the future, such as a car or home loan.

- Peace of Mind: You eliminate the stress of meeting the monthly EMI deadline.

- Financial Freedom: The money that was going toward EMIs can now be invested in SIPs or stocks to build wealth.

Cons of Foreclosure

- Liquidity Crunch: Paying a large sum to the bank at once can deplete your emergency funds.

- Foreclosure Charges Impact on ROI: If the penalty is high and the savings are low, it could prove to be a bad investment.

- Loss of Tax Benefits: The tax deductions available on a home loan (80C and 24b) will be lost.

Data Privacy: Is Your Data Safe?

We know how sensitive financial data is. That's why our Loan Foreclosure Calculator works according to these rules:

- No Server Storage: Our tool performs all calculations entirely within your browser, such as Chrome, Safari, etc. We do not save your loan amount or interest rate on our servers.

- No Registration Required: You don't need to provide your name, email, or phone number to use the Loan Foreclosure Calculator.

- Secure Connection: This website is SSL encrypted, which means your browsing session remains completely private.

Disclaimer (Must Read)

Note: The results shown by this tool are a mathematical estimate. There may be a slight difference due to different banks' calculation methods, such as daily reducing vs. monthly reducing balance.

- Please visit your bank's branch and request the Foreclosure Statement before the final settlement.

- The foreclosure penalty is always applied to the ‘Outstanding Principal,’ not the 'Sanctioned Loan Amount.'

Important Note on Banking Norms: Before closing your loan, it's important to remember that each bank's rules may differ, but they all follow the Central Bank's guidelines. According to the latest RBI guidelines on foreclosure charges, banks can no longer impose any prepayment penalties on floating-rate personal and home loans. If your bank is imposing hidden charges on you, you can visit the RBI's official website to read about your rights. Our Loan Foreclosure Calculator has been designed keeping these standard norms in mind so that you receive accurate information.

Conclusion

Taking out a loan isn't bad, but getting trapped in its web isn't wise. Our Loan Foreclosure Calculator gives you the power to understand the bank's logic and save your money.

If your loan term is still in its early stages and you have extra funds, use the Loan Prepayment Benefit Calculator to plan closing your loan today. Remember, every rupee you save is an investment in your future.

Final Call to Action: “What are you waiting for? Enter your loan details in the Loan Foreclosure Calculator above and see how much you can save today! Don't forget to Bookmark to our tool for more Debt Free Fast Tips.”

Frequently Asked Questions

Will foreclosing on a loan lower my credit score?

Initially, closing an active credit account can cause a slight dip in your score, but in the long run it improves your creditworthiness because your debt-to-income ratio gets better. The impact of loan closure on your credit score is always positive if you've paid all your EMIs on time.

What is the foreclosure penalty on a personal loan?

Most banks charge a penalty of between 2% and 5%. However, some banks also offer a zero-penalty option after the lock-in period (for example, 12 months).

Is there a penalty on home loans as well?

According to RBI guidelines, banks cannot charge any foreclosure penalty on floating-rate home loans. However, they can charge a penalty on fixed-rate loans.

What is the difference between foreclosure and part-payment?

Foreclosure means paying off the entire loan at once. In part-payment, you pay only a small portion (for example, 1–2 lakh) so that the EMI or tenure can be reduced.

What documents are required to close the loan?

You need to provide your ID proof, your loan account number, and a “Request Letter for Foreclosure.” After settlement, don't forget to obtain the NOC (No Objection Certificate).

Is there a tax on interest savings?

No, there is no tax on interest savings. But remember that once you close the loan, you will not be able to claim the tax deduction available on your home loan.

How will I know if I'm saving?

Just use our Loan Foreclosure Calculator India. If the “Net Savings” figure is positive, then you're saving.

Can I close the loan at any time?

Most loans have a 6 to 12-month lock-in period. After that, you can foreclose the loan at any time.